Key takeaways

Edit: Updated for 2023 data on March 2, 2024.

"Show me the incentive, and I'll show you the outcome."

For crypto projects launching a token, determining who receives your tokens and how they're distributed are a few of the design decisions in your control. These critical decisions can materially impact your token's perception and performance, as they're some of the few (and sparse) signals that can clue if the team and early backers have the right incentives in place.

Many projects have been burned in the past, with core team members and early backers prematurely selling their tokens or "dumping on the community." Premature selling usually happens because projects either (a) involve stakeholders who only want to "make a quick buck" or (b) don't implement token vesting schedules and lockups to prevent early sell-offs. So how do crypto founders and operators determine the optimal token allocations and vesting schedules?

Finding reliable benchmark data for token allocations and vesting/lockup terms is much harder than it should be.

Currently, projects publish their token allocations and vesting schedules through a blog post or buried in their public docs. This data is hard to Google for when embedded in an image file or a PDF file you have to download. Sometimes, experts who check on-chain data can verify the published token allocations and vesting schedules. But, the broader public likely won't be reviewing on-chain data and relies on trusting the team to publish the correct data.

There isn't a unified language or consistent definition for token allocations. The inconsistencies make it even more challenging to compare them against each other and aggregate the data. What one project names "Liquidity Mining Programs" can also be labeled by others "Community Incentives," "Farming Rewards," or "Ecosystem Pool." Some combine teams, partners, and advisors into one "Core Contributors" category, while others separate these groups into distinct categories.

A proposal and framework to help make better decisions with tokens

In this post, LiquiFi introduces a definitions framework and data set to help you make better decisions on your token allocations and vesting schedules from leading crypto projects. The broader community can hold teams accountable for publishing their tokenomics and implementing better incentive structures through greater transparency and standardization.

Methodology and definitions

This data set and analysis focus on token allocations, vesting schedules, and lockup terms.

Token allocation is the percentage of tokens distributed to your stakeholder groups. These broad stakeholder groups include:

Vesting

Refers to time-based conditions to earn their tokens, usually for employment. If these employment conditions are not met, the tokens are forfeited by the employee and kept by the issuer (i.e., the company or treasury).

Lockups

Define a period where the tokens cannot be sold or transferred. Similar to vesting, they prevent selling, except there is no employment condition where the tokens are returned since the beneficiary owns them already.

Cliff

Is when a portion of your tokens become fully vested or unlocked on a specific date rather than gradually vested over a period of time. Cliffs can apply to both vesting periods and lockup periods. It is possible to have both vesting and lockups as a token-holding employee, but both are used interchangeably in practice.

For example, some companies implement a 1-year lockup instead of a 1-year vesting cliff to prevent the selling of tokens. Both achieve the same outcome of preventing the sale of tokens for a year, but a vesting cliff has conditional employment terms while lockups do not.

We also see a lockup cliff, where 25% of your tokens are locked for the first 6-12 months (the lockup cliff), and the remaining 75% unlock monthly over the rest of the lockup period. Note that the lockup terms have no relationship with one's employment. Projects use vesting and lockups interchangeably and don't always differentiate between them. So, we treat them the same for this analysis to measure the average duration of preventative selling.

Summary of insights

- Token allocation benchmarks for planning your future distributions

- Token allocations have shifted from 'Public sales' to 'Community and Ecosystem incentives'

- Projects allocate 19% of tokens to investors WHEN they raise capital from private investors

- Project types (DeFi, Gaming, Infrastructure) have distinct token allocations due to the different needs of the business

- Token allocations span a wide range but converge towards standard distributions for certain stakeholder groups

- Vesting/lockup periods are between 3-4 years for Core Team members and 2 years for Investors

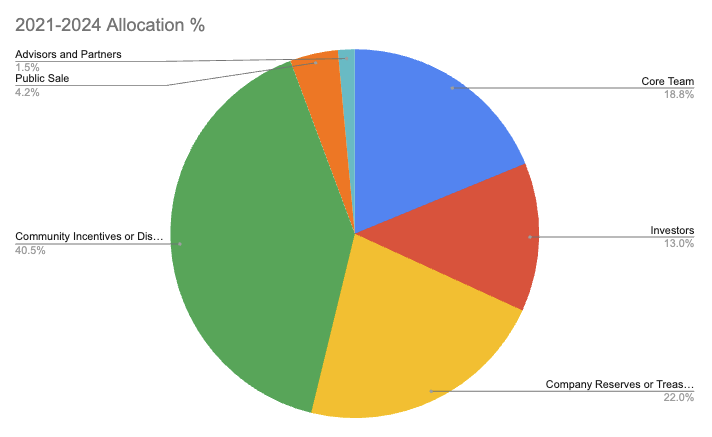

1. Token allocation benchmarks for planning your future distributions

- For your Core Team, we've seen about 18.8% of tokens allocated across founders, employees, and other contributors.

- Investors have about 13%, but this average includes projects that do not have investors on their token cap table, which brings down the overall category allocation. However, if you only include projects that raise tokens with investors, the token allocation percentage increases to 17%.

- Company Reserves or Treasury funds, typically reserved for funding future product, development, and operating expenses, are allocated about 22%. See 'Methodology and definitions' above for more details on how these funds are typically used.

- Community Incentives or Distributions have the largest allocation at 40.5%. The increased allocation makes sense because it helps achieve sufficient decentralization and broad network ownership. It also is the primary way to incentivize usage and early engagement of your product.

- 4.2% of tokens were allocated for Public Sales, including public exchange listings and token sales. This number went down from 55% in 2017, likely due to regulations, and we've observed a corresponding increase in allocations to investors and community incentives.

- Lastly, 1.5% of tokens are typically allocated to partners and advisors.

Use these figures as a rough guideline for token allocation planning and early-stage token grant sizings for hiring or fundraising.

2. Token allocations have shifted from 'Public sales' to 'Community and Ecosystem incentives'

The most significant difference between 2017 and 2023 is the allocation of tokens to public sales and community incentives to bootstrap and fund project development. We've seen the investor token allocation increase while public sales dropped from 55% in 2017 to 1% in 2023.

Instead of projects selling tokens directly on public exchanges or launchpads, projects distribute tokens for engagement and participation rewards (like Uber or Doordash giving credits to use their product). What ends up happening is that the governance or utility tokens, which have no initial value, end up trading on decentralized exchanges (DEXs) and get natural price discovery as the demand for these tokens increases.

With the Company Reserves or Treasury, you can use these tokens to fund operating expenses (assuming secondary market value). Or continue to use the Community Incentives and Distributions pool to fund ongoing engagement and reinforce product value/usage (especially for DeFi projects that require liquidity or marketplaces that require generating supply and demand).

3. Projects allocate 16% of tokens to investors WHEN they raise capital from private investors

Earlier we cited that investors have about 13% of tokens. But, this average includes projects that do not have investors on their token cap table, which brings down the average. Not all projects fundraise from private investors, especially with the rise of alternative funding mechanisms or not even fundraising at all (see ENS). Certain types of projects, like Gaming or NFT projects, use in-game assets or NFT sales to bootstrap their initial development.

If you only include projects that raise tokens with investors, the token allocation percentage increases to 16%. We've seen the investor token allocation (for the projects that bring on investors) increase from 10% to 16% due to ICOs and public sales from 2017 falling out of favor.

4. Project types (DeFi, Layer 1s and 2s, Gaming, Infrastructure) have distinct token allocations due to the different needs of the business

We observe a higher 'Community Incentives or Distributions' for DeFi, Layer 1s and 2s, and Gaming because of the category's specific needs. DeFi and L1/L2 projects need liquidity and capital to get started, and incentivizing community members for bootstrapping TVL is the most common strategy. Gaming projects also aggressively invest in early player growth and community engagement, as the quality of the project is heavily dependent on the number of players and gamers in the ecosystem. Infrastructure projects (e.g., ENS, Biconomy, Radicle, and API3) tend to allocate more tokens to the core team members and company fund, likely due to providing immediate utility without relying on sufficient liquidity or game players.

In future benchmark analyses, we can look for allocation differences among other categories like NFT communities, social consumer apps, exchanges, and marketplaces to see if there are other allocation differences.

5. Token allocations span a wide range but converge towards common allocations for certain stakeholder groups

6. Vesting/lockup periods are between 3-4 years for Core Team members and 2 years for Investors

The most common vesting duration for the Core Team is 4 years and 3 years. Unsurprisingly, vesting terms converge on annual durations (12, 24, 36, 48, 60, etc.). The 4-year vesting period being most common is likely due to the "standard 4-year vesting schedule" in the broader tech industry and companies outside of crypto/web3. The 1-year cliff or lockup is most common, closely associated with the standard 4-year vesting period. 26% of projects have no cliff. We speculate this could be due to projects taking advantage of streaming/daily vesting, unlocked tokens rewarded after the vesting of traditional equity, or enabling the team to bootstrap early liquidity.

Other trends include:

- Weighted vesting (non-linear vest plans, front weighted, back weighted) are used in 7.8% of vesting schedules

- Immediate unlocks are seen in 8.0% of vesting schedules

The most common lockup duration for Investors is 2 or 3 years. Like the core team, lockup durations converge on annual periods (12, 24, 36, 48, etc.). Investors likely see a shorter lockup period on tokens (compared to team vesting periods) because they benefit from earlier liquidity and the optionality of selling. Even for long-term investors, it's better to have the optionality to sell than not to have it which may influence the negotiations on determining their lockup periods. There are also token-oriented investors where the strategy is to sell the tokens as soon as they launch/unlock.

Early-stage investors having a lockup is unique to crypto since tokens are immediately liquid, unlike private equity and shares. The 4-year vesting duration used for employees isn't relevant or applicable to investors since they're locked in as equity/token owners and not subject to conditional forfeiture like employment agreements.

Still, lockup durations and lockup cliffs help mitigate selling pressure and significant drops in price. Most commonly, we see lockup periods for a minimum of 1-year after a token generation event, so that team members and investors don't all immediately sell their tokens at launch.

Critiques of the analysis and methodology

One of the biggest challenges of this analysis is the lack of consistent documentation and data. If every project used the same definitions and terminology, we would be able to gather richer insights and make more interesting comparisons.

Lauren Stephanian and Coopahtroopa put together a fantastic analysis on optimal token distributions, which inspired this post. Our report differs in the definitions used and the industry categories. We hope that others will follow in trying to converge towards a shared standard so that we're all operating with the same data set.

Despite differences in methodology, we both reached similar conclusions on team allocations (18.6% vs. 17.5%) and investor allocations (11.2% and 19% adjusted vs. 17.5%). Lauren and Cooper use different categories and split between Community incentives and Treasury allocations (they separate airdrop and ecosystem incentives), but we still match in overall total allocations around 65%. These differences highlight our earlier point on a lack of industry standards and consistent definitions for tokenomics.

How we can improve the insights and best practices for tokenomics

Our framework introduces a proposal of consistent methodology and definitions for the crypto industry to adopt. Using this framework, we aim to achieve consistency in definitions and standards for measuring in our industry, where each company's data, documentation, and methodologies are fragmented and difficult to compare.

No framework or data set is perfect, and every business is unique. We hope you'll contribute feedback to help this resource become more valuable and applicable. Getting this data is challenging today, and what we're building at Liquifi with our token vesting solution will help make this more accessible in the future. Ultimately, we hope to share best practices for leveraging tokens and accelerating the adoption of crypto applications.

Next steps

We'll regularly publish insights and trends, highlight specific token launches and projects, and share best practices with founders/investors. Follow us on Twitter for updates. Start planning your token allocations, tokenomics, and stakeholder token grants with LiquiFi.

—

Thank you to Packy McCormick, Qiao Wang, Tascha, and Tom Schmidt for your help and insights.

To learn more, visit liquifi.finance and follow us on Twitter @liquifi_finance.

DISCLOSURE: This publication contains general information only and LiquiFi, Inc. is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or other professional advice or services. This publication is not a substitute for such professional advice or services nor should it be used as a basis for any decision or action that may affect your business or interests. Before making any decision or taking any action that may affect your business or interests, you should consult a qualified professional advisor. This communication is not intended as a recommendation, offer or solicitation for the purchase or sale of any security. LiquiFi, Inc. does not assume any liability for reliance on the information provided herein.

.svg)